Home > Faqs

FAQs

We know you probably have so many questions right now that you can’t even keep them all straight. To help you get started, we’d created a list of some of the questions we hear the most from personal injury victims like you.

CATEGORY

- All

- Auto Accidents

- Bus Accidents

- Defective Drugs and Devices

- Medical Malpractice

- Motorcycle Accidents

- Nursing Home Abuse

- Pedestrian & Bicycle Accidents

- Personal Injury

- Slip and Fall

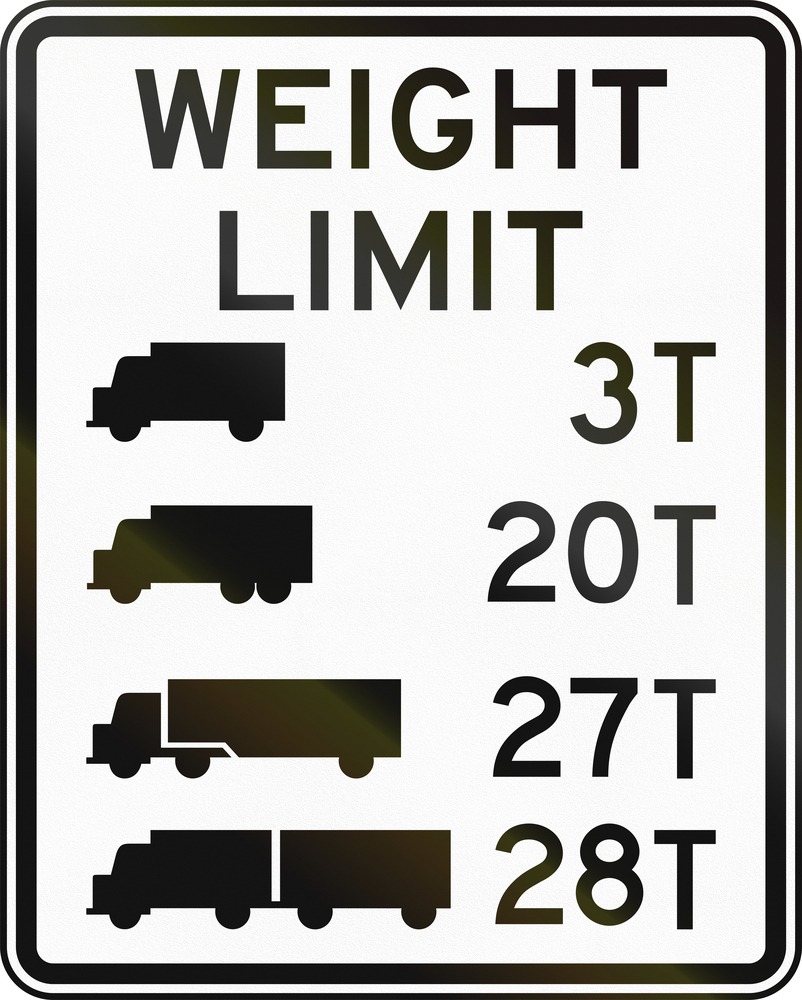

- Truck Accidents

- Workers' Compensation

- Wrongful Death

All

- All

- Auto Accidents

- Bus Accidents

- Defective Drugs and Devices

- Medical Malpractice

- Motorcycle Accidents

- Nursing Home Abuse

- Pedestrian & Bicycle Accidents

- Personal Injury

- Slip and Fall

- Truck Accidents

- Workers' Compensation

- Wrongful Death

Pedestrian & Bicycle Accidents

Can I sue the city if I am injured on a poorly maintained city park trail?

Contact Us Today

Please fill out the quick contact form below for a fast and free case consultation. We will

contact you within 24 hours!